CHAPTER 5: SNEAKER WARS - HOW WAS THE ASP LAW USED AGAINST NIKE?

From the outset Phil Knight’s vision for the Nike brand was always to be first in the field of athletic sport shoes and their ambition was to take the mantle from adidas to become the leading sport shoe brand in the world. As you can imagine all of the other various brands in the pecking order between Nike and adidas were probably not happy to see the upstart Nike brand come out of nowhere and take a bite out of their sales and revenue. If you check out our sneaker brand timeline you can see that brands like Converse, Keds, Brooks, and Etonic were founded long before Nike and Blue Ribbons Sports and many were well established in the sport shoes market at that time.

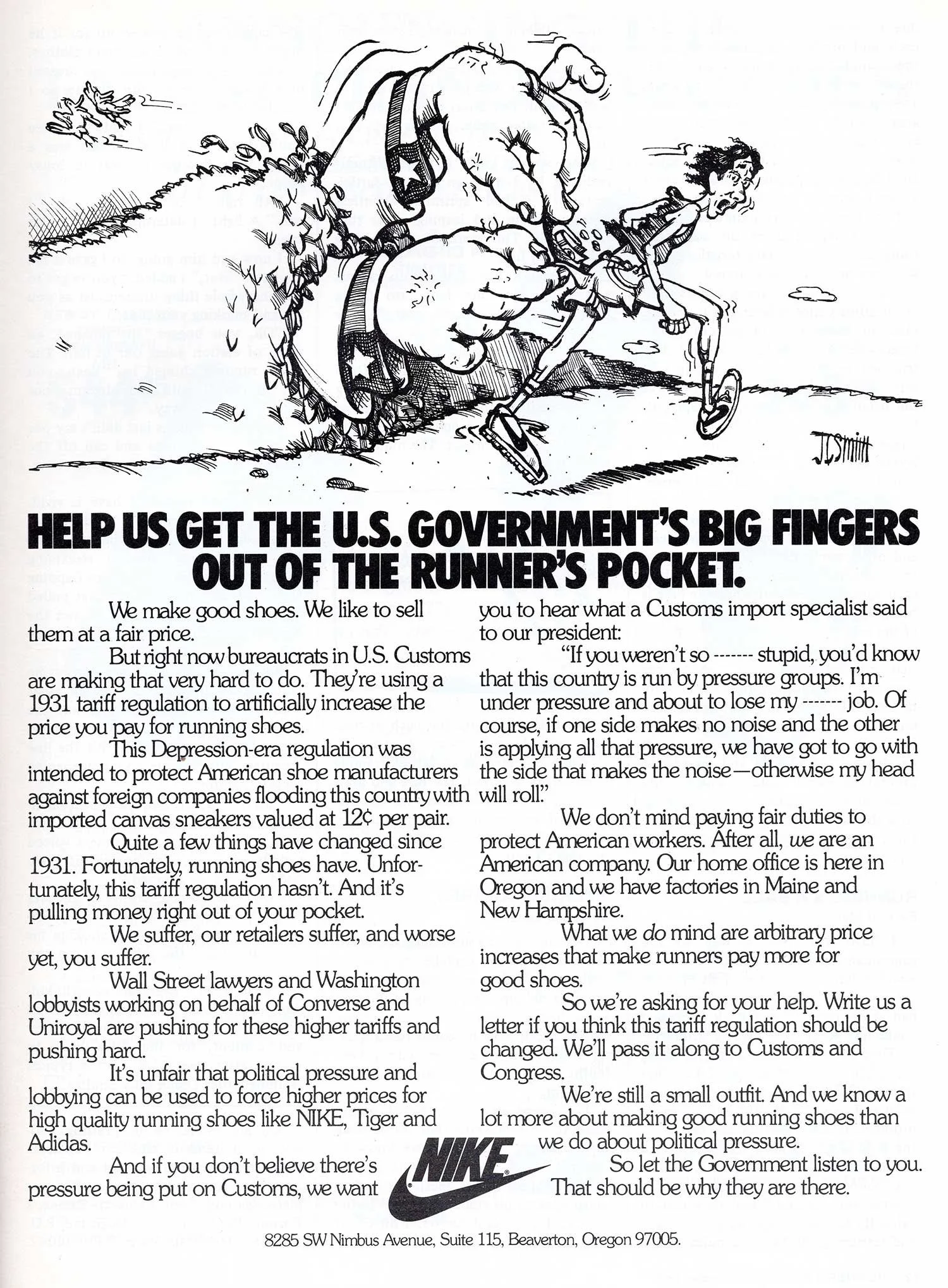

While Nike was making moves to grow their business competing US based brands tried to find a weakness in Nike’s business model. They seemed to land on a strategy that would undercut the core advantage of Nike’s business model and try to turn Nike’s biggest strength, importing high quality sport shoes at a lower price than their competitors, into it’s biggest weakness. The Rubber Manufacturers Association brands teamed up to lobby the government’s Treasury and Customs departments to use the very old ASP law as a cudgel to stop Nike’s momentum.

So that you can understand the dire threat that the ASP fight was to Nike’s business and future here is more from Phil Knight in Shoe Dog:

And then came the letter.

An unimposing little thing. Standard white envelope. Embossed return address. U.S. Customs Service, Washington, DC. I opened it and my hands started to shake. It was a bill. For $25 million. I read it, and reread it. I couldn't make heads or tails. As best I could determine, the federal government was saying that Nike owed customs duties dating back three years, by virtue of something called the "American Selling Price," an old duty-assessing method. American Selling—what? I called Strasser into my office and thrust the letter at him. He read it, laughed. "This can't be real," he said, tugging his beard. "My reaction exactly," I said. We passed it back and forth and agreed it had to be a mistake. Because if it was real, if we actually did owe $25 million to the government, we were out of business. Just like that.

…

Strasser made a few phone calls and came back to me the next day. This time he wasn’t laughing. “It might be real,” he said. And its origin was sinister. Our American competitors, Converse and Keds, plus a few small factories—in other words, what was left of the American shoe industry—were all behind it. They’d lobbied Washington, in an effort to slow our momentum, and their lobbying had paid off, better than they'd ever dared hope. They'd managed to convince customs officials to effectively hobble us by enforcing this American Selling Price, an archaic law that dated back to the protectionist days, which preceded—some say prompted—the Great Depression.

Essentially the American Selling Price law, or ASP, said that import duties on nylon shoes must be 20 percent of the manufacturing cost of the shoe—unless there's a "similar shoe" manufactured by a competitor in the United States. In which case, the duty must be 20 percent of the competitor's selling price. So all our competitors needed to do was make a few shoes in the United States, get them declared "similar," then price them sky high—and boom. They could send our import duties sky high, too.

And that's just what they did. One dirty little trick, and they'd managed to spike our import duties by 40 percent—retroactively. Customs was saying we owed them import duties dating back years, to the tune of $25 million. Dirty trick or not, Strasser told me customs wasn't joking around. We owed them $25 million, and they wanted it. Now.

And more from Nike co-founder Phil Knight’s speech at Stanford.

Gradually, we began to figure it out. This obscure rule had been on the books for nearly half a century, and now U.S. shoe manufacturers – Converse and others – banded together to lobby the government and apply the additional duty on exports in general and us in particular.

They had to make something that met the test of a customs officer who'd never worked in a shoe factory, like or similar, and they then had to sell only a few of those shoes to hugely increase the cost of our shoes going forward if, in fact, the retroactive part didn't put us out of business, which it nearly did.

And another note on how it happened from the Washington Post article 3 Political Heavyweights Have Lined Up for the Great Sneaker snafu by Mark Asher from July 8, 1979.

it was not until November 1977 that the domestic industry "woke up," according to industry spokesman Richard Kaplan. The U.S. firms began sending their brands to Customs and certifying them as similar to the imports, thus claiming the imports were subject to the ASP.

These certified domestic shoes were the comparison shoes that sent Nike’s ASP tariff rates skyrocketing.

ASP MATH

To understand the financial implications of the higher price Customs certified shoes being used against Nike we did some calculations based on the information below from The Washington Post article from Nike lawyer Rich Werschkul and Phil Knight’s quote from Shoe Dog. This is a loose guesstimate on the difference in tariffs based on what Nike was paying vs what they were expected to pay. Based on the information below from Nike lawyer Rich Werschkul in the Washington Post article on the ASP fight Nike valued their imported shoes in or around $7.75 a pair and were paying 20% tariff of that manufacturing cost.

Werschkul also claims that the Customs regulations pertaining to the ASP can be interpreted so broadly that Nike shoes are similar to another brand that wholesales for $7.75. Brooks Co. shoes are in the $11.5- $17 wholesale range.

Nike’s Math - an estimate of what Nike had been paying

$7.75 Nike manufacturing cost + $1.55 (20% import tariff based on manufacturing cost) = $9.30 total import price per pair of sneakers

US Custom’s Math - an estimate of what Nike was expected to pay by Customs based on Brook’s ‘like or similar’ $17 wholesale shoe

$7.75 Nike manufacturing cost + $8.50 (50% of $17 Brook’s shoe price) = $16.25 total import price per pair of sneakers

The difference between $16.25 and $9.30 is $6.95 which may not sound like a lot of money but when you multiply that $6.95 difference over the millions of sneakers that Nike was importing then it would add up to a gigantic bill and many millions of dollars.